original link: https://thegoodaipod.substack.com/p/-podcast-with-nova-credit-ceo-misha

🎙️ Nova Credit CEO Misha Esipov on Financial Inclusion for Immigrants

August 12, 2020

👋🏽 Welcome to Doing Well by Doing Good: The New Startup Model, a newsletter and podcast series highlighting the startups aiming to be profitable with a purpose.

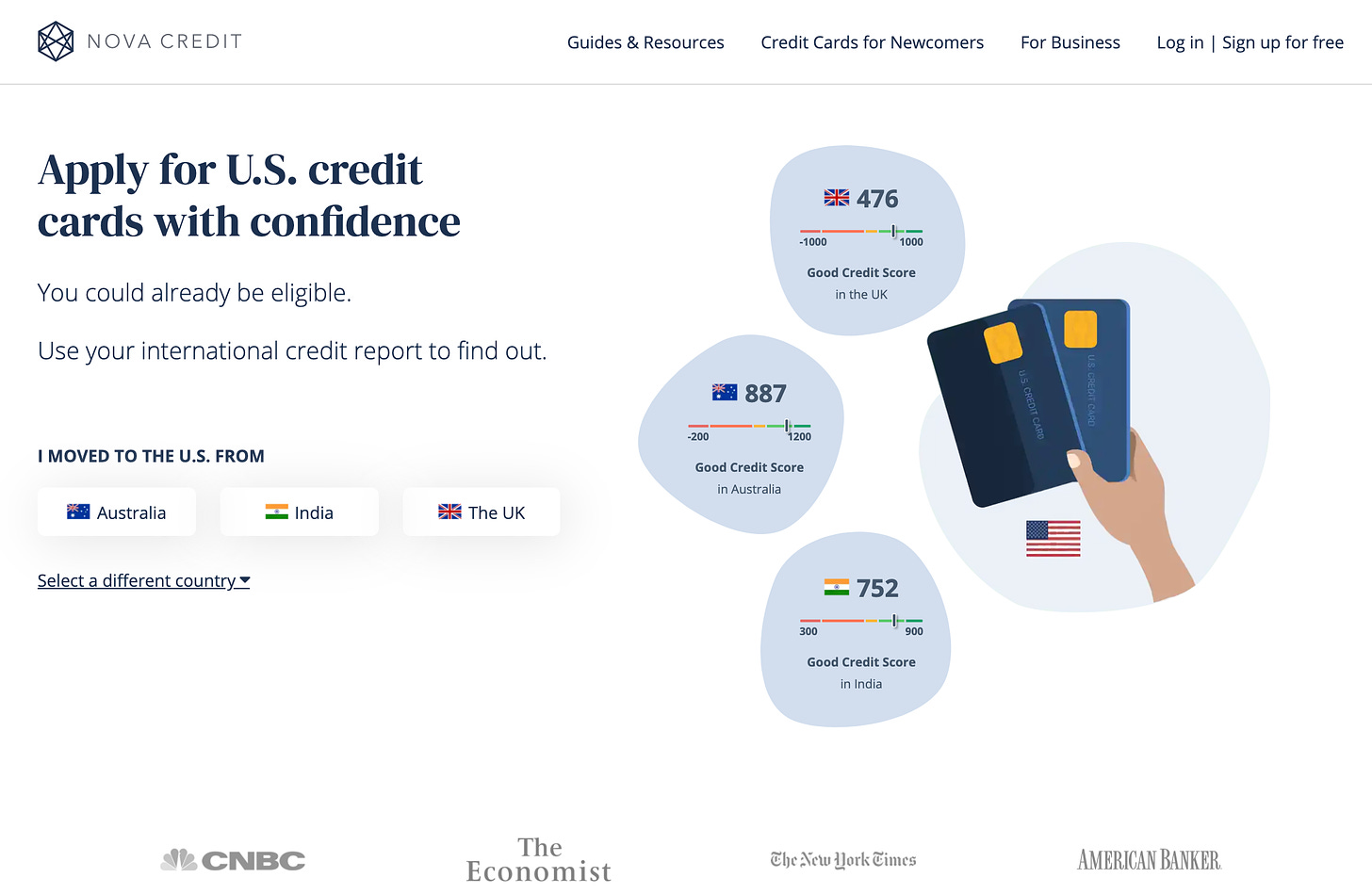

Welcome to our first podcast post! We’re excited to share it with you and get your feedback 😀. We recently had the chance to chat with Series B startup Nova Credit Co-founder & CEO Misha Esipov about financial inclusion for immigrants (screenshot of their website below for reference).

In this podcast we talk about how Nova Credit got started , it’s mission and culture , and how it balancesDoing Well while Doing Good. Misha also gives us a glimpse into how he and his co-founders decided to build a for-profit social enterprise , and some advice he has to would-be entrepreneurs and job seekers looking to make a difference.

Founding Story

Anand [0:36] : All right. Welcome, Misha. Thank you for taking the time.

Misha [0:39] : My pleasure. Good to see you again.

Anand [0:44] : So why don’t we get started? Could you describe Nova credit in one line?

Misha [0:50] : One line, it’s never easy. Nova credit is a global credit bureau that helps newcomers and could access to the financial services that they need? That’s one line. I can add a second, if you’d like. Let me pause there in case you’ve got it.

Anand [1:06] : Please add a second line.

Misha [1:08] : Yeah, I mean the underlying problem for those listening that haven’t heard of us before, is when you first moved to the US from abroad and apply for a financial product of any sort of credit card and auto loan or mortgage, you need to have credit history. And when you first moved to the US, you have no credit history or what’s called a no hit or a thin file or a No file. And what we do is we solve that problem of enabling people to build up credit history by using their foreign credit history. And I can share a little bit more about how we do that a bit later.

Anand [1:43] : Got it. That sounds great. That’s a great, great start. And honestly, this is why we wanted to talk because I think Nova Credit is certainly Doing Well by Doing Good. So I thought that we could start with a background. So what was your founding journey? How did you get here?

Misha [2:01] : So Nova started actually as a class project at Stanford, back in 2016. We were grad students interested in financial services more broadly. And we were interviewing classmates and friends and anybody who would give us any time about their experience with finance and asking very basic questions around, you know, do you have a credit card? How did you make the decision for that credit? How did you decide which credit card to go for? Do you have a student loan? Did you make that decision? What’s the rate and very quickly, we realized that half of the people we were speaking with were foreign, and 100% of that half would share the same narrative of, I can’t get a credit card, I can’t get an auto loan, I can’t get a student loan. I have to go beg my classmate to put me on their family plan at T-Mobile or wherever. And it was just very, very clear that there was a real burning need for a group of people for a very niche segment of the US population that we thought we could solve. And so the underlying problem, as I alluded to earlier is that when you first come to the US, you don’t have any US credit history. And so we then set out and now spent the better part of four years solving that problem by enabling people to access their own credit history from their home country. So let’s say you move to the states from Canada, or Mexico or India or UK, we go out and we access your credit history in your home country. And we will instantly translate that information into what we call a Credit Passport. And a Credit Passport or the spirit of it is the same way that a passport is how you travel the world and enter into a new country. Your Credit Passport is how you access financial services, globally. And so we will then take that information, transform it into a new format in the US and deliver that to support your eligibility for a product in the US. So the user experiences is I want to get an American Express card as an example, or a student loan, I’ll go and apply for those products online. Once the lender determines that you don’t have enough US credit history, we emerge in that user journey. And we’ll go and pull your history with your consent from your home country and deliver that to somebody like American Express. And by doing so, increase the likelihood of your ability to get approved.

Anand [4:22] : That’s awesome. So then the user is as an immigrant, they’re able to access financial services that they couldn’t otherwise. And in your case, or in the Nova Credit case, what you’re doing is you’re actually coming in when they realize they can’t access that service.

Misha [4:36] : You got it. And we come in not on a direct-to-consumer basis, we come in through the enterprise. So a consumer who has chosen to apply for a product, we can actually go and support their ability to get access to that product in real time. And the founding journey was one I sort of danced around that a little bit. The founding journey is really one of realizing there was a real problem when you go on here. We spoke probably with 150 to 200 classmates and friends and did a ton of user research and interviewing. And it just became really clear that immigration is an incredibly vulnerable period of transition where you have to, obviously relocate, most likely learn a new language, potentially retrain yourself professionally. And when you do that, you also are moving into a world where you don’t have the same social safety net that you had in your home country. In your home country, if something goes wrong, you’ve got a network, you’ve got family, people to lean on who can support you, but in the US if something goes wrong, or if you need access to to finance you can only really rely on US banks. And those banks aren’t able or historically have not been able to serve you because they don’t know who you are. And so we identified this data problem, which ultimately Nova Credit solves, as an information asymmetry that exists and Nova Credit has built the infrastructure that solves that hole.

Mission & Culture

Anand [6:07] : That makes sense. This is very interesting founding story and I’m sure there were many ups and downs along the way as well. I’m curious about your mission. So what is your company mission? And how do you create a culture everyday that embodies it?

Misha [6:27] : Yeah, our mission as a business is to inspire and facilitate the flow of human diversity and what that means is we don’t believe in diversity for simply the sake of diversity. We believe in diversity because we believe it creates a better world, a richer culture, and a more exciting world to to be a part of. Obviously, diversity is a very big topic right now, with everything going on in the world. And we’ve really put diversity at the center of our mission from the very beginning. I mean, core business has been focused on diversity of people from around the world. But over time, we see this mission as an opportunity to expand beyond the immigrant and the newcomer segment and really starting to focus on economic mobility and economic diversity and helping people rise up across the US economy. In terms of creating a culture that embodies a mission, it’s really about being very deliberate and creating company rituals. So I’ll give you an example or a few examples. At every all hands since our founding when it used to be three of us, we do this thing called Nova Credits, pun intended, where we go around and we give somebody credit for something that they did during the course of the last week, an anchor that credit in one of our four key company values. Another example of a ritual is we sort of created our own holiday on our anniversary, every year, every time we turned a year older, called Nations Day, where we invite obviously the company plus ones and twos and threes and investors and people that have been around the company and involved in any capacity. And we celebrate the richness of the world, how diverse having a group of people from all over the world working together on a shared mission. That’s another example of a ritual and so for the founders out there interested in creating a rich culture, it’s really about being very deliberate in how we create rituals that embody our mission and embody our values.

Anand [8:50] : I also remember visiting your office and seeing all those flags on the wall. Those are pretty powerful. I still remember it.

Misha [8:58] : It’s I mean, it was one of those rituals where every time we build a new country integration, so when we added India or Mexico or the UK, we added flags from those countries to our walls, we also added maps, historical maps of those countries that everybody in the company got to sign that are on our walls in the office. It’s little things like that, that go a long way in creating this environment and this sort of sense of shared mission.

Anand [9:24] : Makes sense, and primarily for you guys, it’s really about diversity as well, and making sure that it’s a key part of the mission.

Misha [9:32] : Yeah, for sure. And it’s not only part of the mission, it’s part of our company strategy is one of our objectives and our OKRs, the last three years now has been focused on creating a diverse team where everybody can be their best self. And that’s another area that we, as a leadership team and executives and as a company, we spent an incredible amount of time to ensure that we’re building an organization that is enduring.

Doing Well

Anand [9:58] : Awesome and that’s actually a great segue into the next part, which is, about Doing Well by Doing Good. The first part of that is doing well. What is your business strategy? And you don’t have to mention all of it here, but how do you make money? How do you make your business sustainable in the short term and long term?

Misha [10:18] : Yeah, so Nova Credit is is free for consumers, we don’t charge consumers anything. We make all of our revenue through the enterprise. So the way our business model works is when a consumer decides to apply for a new financial product, credit card, student loan, auto loan, mortgage, or whatever, without Nova credit, that consumer in unable to get approved because like we talked about earlier, they don’t have a US credit history. Through our capability, we significantly increase their likelihood of approval, and every time that we get somebody approved, we create value and ultimately, the enterprise is willing to pay us some revenue or an enterprise license in order to be able to attract and retain this customer segment. And so the value prop to to the financial services industry is that the immigrant or the newcomer customer segment is one that is highly attractive, yet structurally underserved. And it’s also really large in terms of its representation of US population growth. So, newcomers today account for the majority of US population growth. I think it’s roughly 60% right now. There are more people who move to the US every year than there are new Americans born. And if you fast forward 2030 years according to the US Census Bureau, US newcomers are expected to account for roughly 80% of population growth, meaning that there are five times more people moving to the US than there are Americans born and that’s a function largely of a declining birth rate in the US and that’s a demographic challenge that we have as a country that’s being filled with migration.

Anand [12:06] : That’s actually very intriguing. I did not know that stat. So then, if I understand correctly, the more credit passports you provide, to end users, essentially, the more the more money you can make at the same time, the more impact you’re making, because the more you’re providing access to each one of these end users.

Misha [12:29] : That’s right. So every time we help somebody relocate to the US and get established with all the services that they need—getting their bank account, getting their credit card, getting their student loan, getting their cell phone plan, getting a place to live in an apartment lease—those are opportunities that prior to Nova have information challenges and are really hard to access. But by plugging those holes we are able to create a win-win, we’re able to create a win for the consumer because they will get the service that they need and we’re able to get to create a win for the enterprise because they’re able to retain a consumer that they otherwise don’t know how to serve.

Anand [13:05] : Got it.So it’s a win-win-win for everybody. Cool. One follow up question on that. Have you ever had a case where creating value for business shareholders has been in conflict with your mission or culture? And how have you resolved that if that were ever the case?

Misha [13:27] : Yeah, I mean, you run into this challenge all all the time, right? Where you have to, when you’re figuring out your product roadmap or where to focus your go-to-market efforts, ultimately, as a venture-backed, social enterprise, we need to establish an enduring business model. Otherwise, we are default dead as a company. We won’t survive and won’t be able to bring to life the potential of what our company stands for and all the good that it can create. So there’s constantly this tension of how do we drive commercial outcomes, how do we drive more revenue for the business which can come and come in conflict with how do we drive the most impact. So for example, if you are a migrant to the US, that does not have foreign credit history, that is a problem that we really can’t solve today. But arguably, many of those consumers are actually most in need. And so from a mission perspective, we want to solve that problem. And I hope one day we will solve that problem. But we haven’t quite cracked the product for how to do that as well as a commercial opportunity for how to do so in an enduring manner. And so we have to focus on consumers who have credit history in their home countries. And in doing so we can create a create that win-win-win establishing an enduring business model, and then have the opportunity and the privilege to go and solve higher impact problems even beyond the core one.

Doing Good

Anand [15:03] : I thought this is actually a perfect transition into doing good, Because you talked a little bit about how you’re helping a number of different segments, and that you hope as you grow and as you get larger, you can hopefully address some more of those segments that that you currently may not. So in 10 years, when Nova Credit is this huge success, what global challenge will you have helped solve?

Misha [15:31] : Globally, there are more migrants than there are people in the US. So it’s an incredibly large population around the world. Not all of them face this problem today. For example, I immigrated to the states from Russia, I have a US credit history, I’m not faced by this challenge anymore. But if I were to move to Canada or the UK or wherever, this is a problem that I would face again, and so my hope is we’ll get there faster than 10 years. And my hope is that the challenge of accessing financial services around the world as you move around the world will become a solved problem. And I think we’re in an incredibly strong position to be able to be the ones that solve that problem not only here in the US, but wherever people move the UK, Canada, Singapore, Australia, Hong Kong, Dubai, etc. I think beyond that there’s an opportunity to create a more global financial ecosystem. And that really speaks to this notion of how consumers today are really siloed in terms of their ability to access financial services only where they are domiciled. So if you’re based in Mexico, you can really only get access to financial services from Mexican financial institutions. But my hope is in a 10 year timeline, that paradigm will shift where no matter where you’re based, if you have custody, if you have control, if you have access to your own information, you have an opportunity to access Financial Services around the world. And I think that can create a really exciting shift that creates a huge benefit for consumers and their ability to get the best products, not only in their home country, but wherever those best products may be around the world. It’s a similar parallel to how you can shop on Amazon, all over the world, or buy stocks all over the world. Many, many industries have become really global, and are available globally. But the financial services industry is still very much siloed to a national border.

Anand [17:33] : So then basically global access to financial services, no matter where you’re from.

Misha [17:39] : You got it. That would be a really cool world to be a part of, because ultimately, it makes it creates better financial products for consumers all over the world. And that’s the world that we want to be a part of.

Why For-profit?

Anand [17:51] : You alluded to this a little bit before, but why build a for-profit business as opposed to a nonprofit?

Misha [17:59] : Yeah, this is a debate, my co founder, Nicky and I, had many times in the early days. And I think ultimately, the reason that we settled on a for-profit model is that we believed that we could solve this problem a lot faster and with a lot more scale as a for-profit business. And that really hinges on our ability to access capital as a company and to raise the capital we need to assemble the team to solve the problem that we’ve set out to solve.

Anand [18:33] : Yep, so it’s a matter of capital and a matter of growth.

Misha [18:38] : It’s capital, which allows you to assemble the team that you need in order to solve the problem that you’ve set out to solve. So now we are a Series B business and we raised about 70 million as a nonprofit and assembled the caliber of team that we have? I mean it’s possible but I’m a believer in the fastest path to creating impact is as a for-profit social enterprise. And that’s really the philosophical approach that we’ve taken.

Advice for Listeners

Anand [19:12] : Yep. Makes a lot of sense. This has been great, by the way. Thanks again for taking the time. I wanted to end off this interview with a little bit of advice for the audience. I wanted to ask you what advice would you give to founders trying to build a Doing Well by Doing Good startup like Nova Credit, or professionals looking to work for one?

Misha [19:35] : I got maybe two thoughts on this one. For the founders out there, I think be really honest with yourself about whether the problem that you’ve set out to solve really resonates with you because obviously the founding journey is not an easy one. It is a hell of a roller coaster. And there are far more lows and there are highs and so you have to deeply care about this problem, otherwise you won’t endure the roller coaster that you’ll have to go through in order to actually crack it. You know, one of my mentors when I was first exploring starting Nova, you know, we spent a lot of time just like thinking through the problem statement, and I really struggled with finding the courage to actually start the business.

Anand [20:32] : I could never imagine you wavering on starting a company seemed like a natural founder.

Misha [20:38] : It was a really tough call for a variety of reasons, because there’s a lot of, you know, a lot of risk or perceived risk in starting a company. But one of the pieces of advice that most resonated with me was:

“you can never cross the chasm in two steps. It always takes one giant leap.”

And what that meant to me is, as we were learning about this problems and were conceptualizing what a product solution could look like, we kept learning more and hoping that by learning more we would remove the leap of faith involved in actually going out and starting a company. But in reality, the more you learn, the more you know is harder to solve. And so that also increases the perceived risk despite you knowing more because you know more about the challenges. And so ultimately coming to terms as a founder and having to find the courage to actually just give it a shot, is a life’s work in and of itself for a lot of people. It was years of work for me. But I look back at that decision of actually going forward with starting Nova with incredible fondness because it’s resulted in a very rich journey, rich in the sense of building character, and really growing as a human in building this business, and we’ve got a lot more to do. We’re only just getting started and only starting to have a chance of becoming a viable and enduring company.

I think for the, you know, professionals out there that are not interested in founding, but are looking for businesses that are Doing Well by Doing Good. My advice would be to really focus on this combination of team, impact and learning. Those are signs. That’s kind of like the Venn diagram, that I think about making professional decisions and anytime I’m speaking with somebody about or offering some perspective on career decision. I think how you rank those is going to be different for different people over time. Some people impact is the most important thing other people learning other people team. I think it’s a personal decision for how you rank those three. But ultimately, you want to find an opportunity that has all three, you want to find a team that you are incredibly excited to be in the trenches with. You want to find a role and an opportunity that is going to grow you as a functional leader, as a person that’s going to drive your character development. And you want to find an opportunity that actually resonates with you emotionally in terms of the impact that you’re having. You want to find an opportunity where at the end of a hard day you can look yourself in the mirror and say I’m proud of what I’m working on. And irrespective of the outcome, whether this becomes a huge success, or it flattens out, or we’re going to spend 10 years and not really get anywhere, I’m proud of this chapter, because I care about dedicating a chapter of my career to solving this problem.

**Anand [23:28] : **That’s super actionable advice. With that, thank you so much for the time!

**Misha [23:33] : **Anand, my pleasure. Thanks for taking the time to listen a little bit to our story.

Hope you found this insightful and interesting (and not boring)!

Special thanks to Misha and Nova Credit for sharing how they are building a for-profit business while creating a more equitable society and ensuring that all immigrants can thrive financially.

We’re just getting started with our interviews with founders, and we’d love to hear from you! If you have any thoughts about how we could improve the podcast, or have any questions you’d like answered by founders, you can respond back to this email or hello@doingwellbydoinggood.co or tweet us at @dwdgsf.

Until next time 👋🏽,

Anand