Original Link: https://thegoodaipod.substack.com/p/-impact-investing-for-a-better-world

📈 Impact Investing for a Better World 🌍

An Alternative Path to Doing Well by Doing Good

Sep 16, 2020

👋🏽 Welcome to Doing Well by Doing Good, a newsletter and podcast series highlighting the companies aiming to be profitable with a purpose.

Today, we’re discussing how Doing Well by Doing Good is not just a strategy to BUILD a business but is also a strategy for those INVESTING in social impact businesses.

DISCLAIMER: I am NOT an investor and cannot claim to know what I am talking about — but if you find yourself curious about the mechanics of impact investing a good place to start isthe GIIN website.

Socially Responsible Investing (SRI) or Impact Investing is nothing new. In fact, it’s been around for ages as far back as biblical times—1500 BC. It has evolved through multiple forms through religions like Judaism, Islam and Christianity among others and in recent years has been driven by the demands of a democratic electorate (e.g. in the US during Vietnam, the Cold War, and many others).

Turns out that even today we are making history with COVID-19 driving a new wave of impact investing as investors are starting to realize returns on their portfolios and identify the fragilities in our economy as investable trends for the future.

One of the best definitions of Impact Investing comes unsurprisingly from the Global Impact Investing Network (GIIN)

_Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Impact investments can be made in both emerging and developed markets, and target a range of returns from below market to market rate, depending on investors’ strategic goals. _

The growing impact investment market provides capital to address the world’s most pressing challenges in sectors such as sustainable agriculture, renewable energy, conservation, microfinance, and affordable and accessible basic services including housing, healthcare, and education.

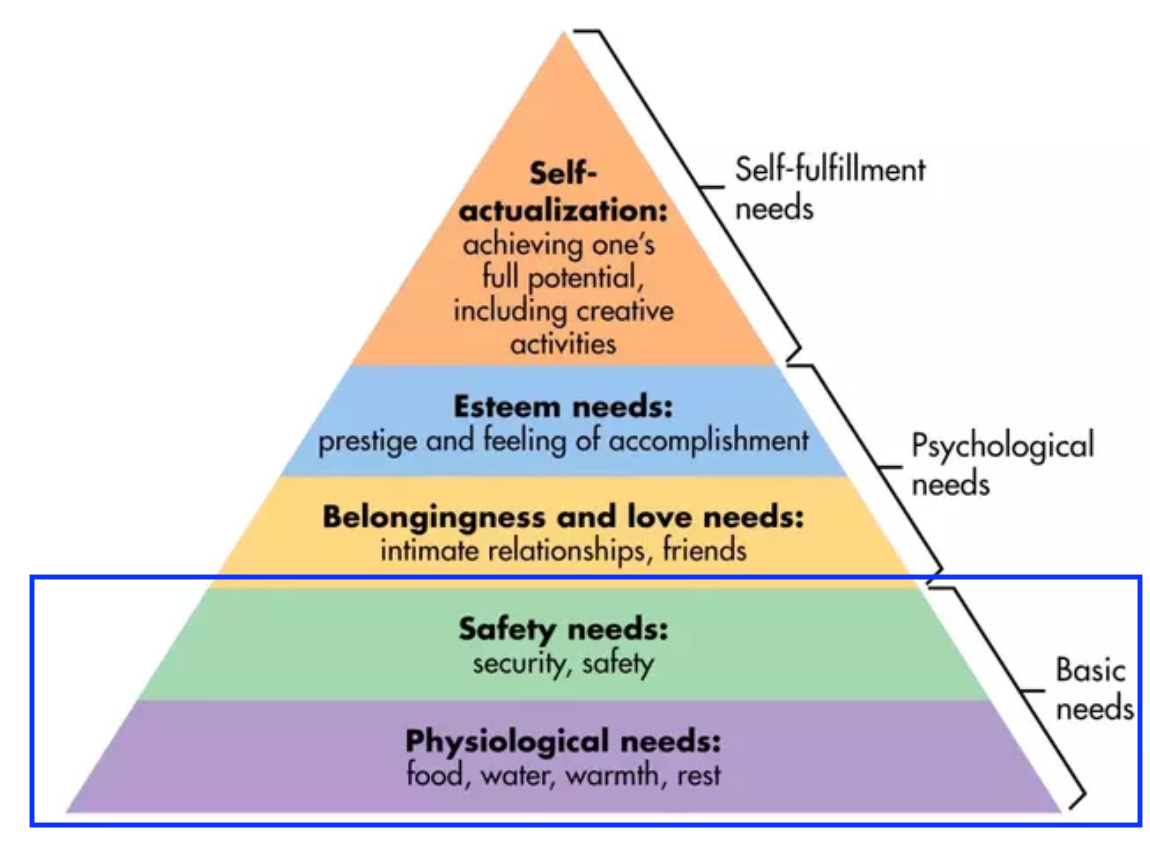

Doing Well by Doing Good is inherent in the definition. In the same way that any company wants to make a profit, any investor wants a return. The KEY difference in Doing Well by Doing Good for a business OR investor, is that they aim to make a positive impact as described in the second paragraph above. As we’ve defined before, these “positive impacts” are none other than the “Basic Needs” described at the bottom of Maslow’s Hierarchy.

Impact Investing is just another form of Doing Well by Doing Good.

In this post I’ll list out some representative small and large examples doing just this. Since all of them inherently deploy capital, their Service and method of Doing Well are common:

Service : provide money, advice, and guidance to the organizations and individuals they invest in.

Doing Well: make money from the returns they make on their funds.

SO, for brevity the 2 key components that differentiate these firms are their Mission , and how they Do Good (i.e. what good do their portfolio companies do and how do the firms encourage or reward that), which is where we’ll focus in our descriptions.

_ NOTE_ : While below we will just sample a few investors from later stage and early stage pool, we’re keeping track of many more and will share the full list another post soon along with other DWDG companies 🤓.

First let’s start with some of the BIG PLAYERS in the impact investing space

Breakthrough Energy Ventures

Bill Gates recently founded this climate related investment firm out of the Breakthrough Energy Coalition with a key focus in funding next generation technologies and advocating for improved policy levers. A combination of many high net worth individuals, the fund has collected over 1B more over the next year.

Mission : “to lead the world to net-zero by supporting cutting-edge research and development; investing in companies that turn game-changing technologies into scalable and transformative solutions; and advocating for policies that speed innovation from lab to market.”

Doing Good: In today’s world, energy is key to survival for many communities all around the world. Access to clean and sustainable energy through microgrids is one of the only ways to receive power in many parts of the developing world, where large scale infrastructure can be cost-prohibitive. As the companies grow and expand their reach, access to reliable energy as one of the “Basic Needs” will also grow.

Elevar Equity

Elevar Equity is a self-proclaimed “early growth capital” investor focused on bridging the inequity gap for marginalized communities.

Mission : “to fuel the economic resilience and vibrancy of low income communities. By spending considerable time with our customer segment, we develop a deep understanding of their aspirations, priorities, cash flows and challenges. Combined with uncompromising analysis, we translate this into concrete investment insights that are the basis of our investing in ‘deep in the weeds’, solution oriented entrepreneurs.”

Doing Good : Elevar makes it crystal clear that the businesses they fund cannot have impact as a “side metric” but rather impact should be correlated and aligned with business success. Impact for them means solving inequity for those marginalized populations and their companies success continue to drive equity in access to the “Basic Needs”

Last but not least, the Early Stage VCs and Accelerators focus on building up and helping companies mature from nascent seedlings to formidable businesses. Of course in general there are MANY more smaller VCs and Accelerators than later stage firms, but most of these firms cannot be too focused because they have to diversify sufficiently. Thankfully impact investing spans a fairly wide gamut.

SustainVC

SustainVC is a 10-year-old manager of a number of early-stage impact investment funds focused on investing in companies creating meaningful social and/or environmental impact spanning topics from climate & sustainability, equality & empowerment, and health & education.

Mission : “The goal of our funds is to return measurable social and environmental impact as well as market-rate financial returns **** by backing innovative entrepreneurs that share a vision of a sustainable, more equitable and healthier world”

Doing Good : SustainVC ties doing good directly to their mission statement by ensuring that each investment fits one their key high-level buckets. This means as the companies grow (and subsequently increase the value of their return), they deliver more impact in those buckets, all of which fit squarely in the bottom-rung of Maslow’s Hierarchy.

Blue Ridge Labs

Blue Ridge Labs is an accelerator based in New York born out of the The Labs program within the Blue Ridge Foundation and is now part of the poverty-fighting organization Robin Hood helping to propagate and help early stage companies that address economic inequality in New York. Doing Good sometimes can seem difficult when common startup advice revolves around “solving a problem you know best”, but by definition, those with the privilege to think about starting a company statistically will not have come from such a background. Blue Ridge Labs helps build the bridge between technologists and the communities that need the help.

Mission : to solve economic inequality in New York through tech-enabled solutions

Doing Good: Blue Ridge Labs is aligned with the core missions and values of the poverty-fighting Robin Hood foundation and funds both non-profit and for-profit organizations nearly equally that address economic inequalities in New York. Access to capital in low-income communities typically centers around the key “Basic Needs” of Maslow’s Hierarchy naturally as a key need for survival. As their portfolio companies thrive, wealth distribution drives more equitable distribution of these “Basic Needs”.

We’ve only sampled a few above, but over the last few years there have been a lot of developments in this field including 2015 benchmarks compiled by GIIN and 2017 report on the financial performance of impact investment funds which highlight not just who these companies are, but also how they are performing. Short answer? They have been doing quite well and while these reports have the details — these funds are feeling pretty good

TLDR; Impact Investing comes in all shapes and sizes, but the ethos is still the same—make a difference while making a return on investment. Much like we’ve heard from founders of Doing Well by Doing Good companies, if the business doesn’t fundamentally work, the returns don’t work and business sustainability and social impact isn’t achieved.

Do you have some thoughts about Impact Investing or ideas for topics or companies we should talk to? If so, we would love to hear them. Until next time…

L8r 👋🏽

Anand