original link: https://thegoodaipod.substack.com/p/-is-robinhood-doing-good

📈 Is Robinhood Doing Good?

🧐 Does the mission stand up to the the numbers?

Jan 31, 2021

👋🏽 Welcome to Doing Well by Doing Good, a newsletter and podcast series highlighting the companies aiming to be profitable with a purpose.

With all of the craziness with $GME, Gamestop (… I’ll never forget those visits to get the latest games as a kid), Robinhood shutting down trading, and Robinhood explaining themselves, seemingly much of tech and finance world has been up in arms for all different reasons.

Robinhood is an interesting company, because its mission is broad enough to suggest it is Doing Well by Doing Good , but the reality of its customers and how much it contributes to helping the most vulnerable populations, is not clearcut.

From reports of foul play to calls for caution given Robinhood’s reckless history, everyone is getting in on the frenzy. But this got me thinking, mission and Doing Well by Doing Good aside, how much social good does Robinhood actually do?

Disclaimer: I am by no means an expert and this analysis will be cursory since it still is a private company and we don’t have all the numbers

Typically we would wait for the S-1 to analyze Robinhood, but given their position as a brokerage we found a lot of numbers online about their dealings.

In this post, we’ll explore how Robinhood, still pre-IPO, makes it’s money and calculate the a TENTATIVE measure of the social good it creates through it’s stock trading platform. First, a TLDR; for those who want the answer — then the basics 😀

TLDR;

Robinhood’s Tentative Social Good Ratio : 10.2B ~ 0.76%

What is Robinhood 📱?

**Robinhood **is a company and app founded by two former physics PhDs, Bhaiju Bhatt and Vladimir Tenev, two previous quants, who realized they wanted to make the financial markets accessible to anyone even with just a few dollars to spend.

Robinhood’s mission, much like the folk hero himself, is

_ To democratize finance for all. We believe that everyone should have access to the financial markets, so we’ve built Robinhood from the ground up to make investing friendly, approachable, and understandable for newcomers and experts alike._

How Do They Make Money?

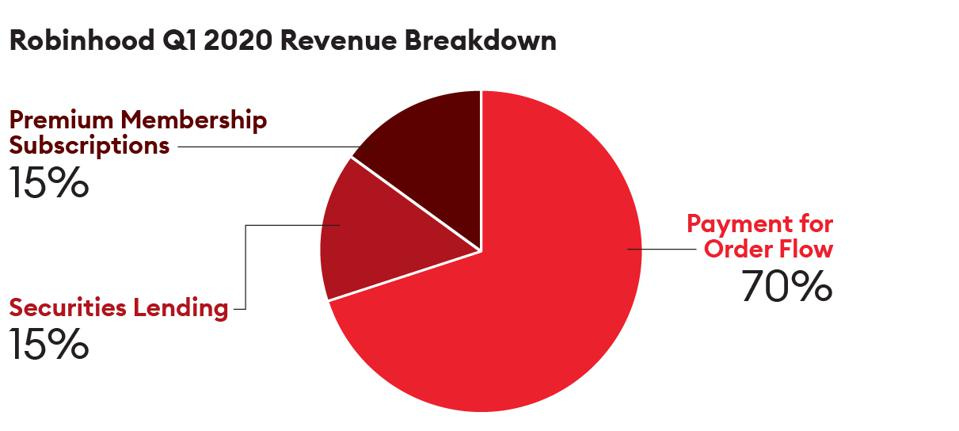

According to this Forbes Report, the largest component of Robinhood’s Q1 2020 revenue is “payment for order flow,” or PFOF. In the tech world, we might call this “selling the data”, which in the finance world is fairly common, as co-founder Baiju Bhatt notes, but they also have more traditional SaaS revenues on premium products.

-

Premium Membership Subscriptions: SaaS revenue from value-added services like Robinhood Gold

-

S ecurities Lending: Lending customer securities to customers (e.g. hedge funds) for cash collateral [Job Description]

-

Payment for Order Flow : Selling order data to Algorithmic Quant Traders

This breakdown is fundamentally different from traditional brokerages like E-trade where PFOF is a minority of the revenue < 20%. This then begs the question, how does this help the user?

Honestly we may not need to know these numbers since most don’t affect the users directly other than the premium membership services, but they help frame the business model.

Show Me the Numbers

Data outlining the potential returns of an app like Robinhood in fairly sparse, but to start there is a lot of good information on the money made and transacted on the Robinhood app. According to App Statistics on Robinhood, some key metrics about users, and amount managed are pretty staggering.

-

13M Users in 2020

-

$180M Q2 2020 Revenues

-

$150B of transacted trades

-

5000 range of user accounts, median: $2000

-

**600B under assets from E-trade)

-

$10.2B valuation

Most interesting however data from Robintrack as of Dec 2020 (website since shut down), which shares a bit more about the popularity of trades and some inkling of the types of returns and losses experienced by users.

-

Robinhood users are 10% more likely to buy and sell top 10 stocks than users on other brokerage sites

-

11% - 42% returns followed by - 5% to - 9% losses the month after on “Herding Events” defined as 0.5% of events where there is a user increase of more than 1,000 and more than 50 percent relative to the previous day

-

63% of the time returns are positive (average of 3.5% to 6.4% in extreme scenarios) if every user uses a strategy of selling after a Robinhood “Herding Event” and repurchasing five days later.

How Much 💵 Does Robinhood Generate for Their Most Vulnerable Users?

Let’s first look at the users — how do we characterize “vulnerable”. We know the range is 5000 average holdings on the platform with a media of 2000 to be the user base we care about. Given it’s a skewed distribution, we estimate this at ~20% of 13M or ~2.6M users.

_NOTE : True demographic data is needed to truly identify the right user segment since the average account amount is a poor indicator of socio-economics since it is conflated with trust in Robinhood, and perhaps even negatively correlated to those with wealth who may be trading on more traditional brokerage platforms. _

Of these 2.6M users, we assume that the vast majority are unsophisticated, which argues that the majority, let’s say 70% of whom will play a “medium strategy” akin to that suggested above by Robintrack with 63% success or worse. We assume we take out outliers from both tails (more from the high end than the low end because “beginners luck” is not as likely), then the average return of 3.4% reduces by a bit to say 2.5%.

Since we only selected users with accounts < 1200, which on an annual return of 2.5%, nets:

30 / user / year

Tentative Social Good Ratio

Overall, this amounts to $78M in value generated for these users. Of course, this is pure financial return. There is much to say about the enjoyment of day trading and the fun that someone may gain, but the assumption is these users are focused on the monetary outcome rather than the auxiliary benefits.

Much like public companies with a direct Market Cap, we compare this to the latest valuation of Robinhood @ $10.2B to come up with the Tentative Social Good Ratio

_ Tentative_ Social Good Ratio: 10.2B ~ 0.76%

Without a full S-1, much like the very traders on Robinhood, much of this calculation is speculation **** and more data is needed to confirm or deny this. It’s very possible Robinhood is helping unsophisticated traders execute better strategies as their data moat becomes bigger, and the numbers are and will be much better than we can see today… we’ll come back to that once we have that.

Conclusion

Robinhood, isn’t Doing Well by Doing Good in the sense of our blog here, since the users and the fundamental purpose of the app targets people with some extra cash to burn, but Day Trading is risky business and it’s hard to say enabling it for less sophisticated users is all good. But they are doing _some good. _Posts like this one are more about highlighting the “Social Good” any company can do even if their product or service doesn’t directly deliver that.

When it comes to doing good companies, just take it from Pete:

So in case you were asking yourself: _ “Should I keep trading with Robinhood?”_. If you think they’re evil, they certainly aren’t completely. They are making a positive impact, even if some of their practices are can seem predatory because of how they mirror traditional banks. The reality is, every company needs to make money, the only question is, how much of that money can contribute toward helping those that need it most rather than just the **** 1%. The debate still continues… And hopefully with Robinhood’s S-1 coming out soon, we’ll be able to revisit this very soon.

Maybe we should start to question the motives of some companies themselves, but just remember that if we look for it, we can find good in many unexpected places.

Stay positive, stay sane, and stay healthy!

✌🏽Anand